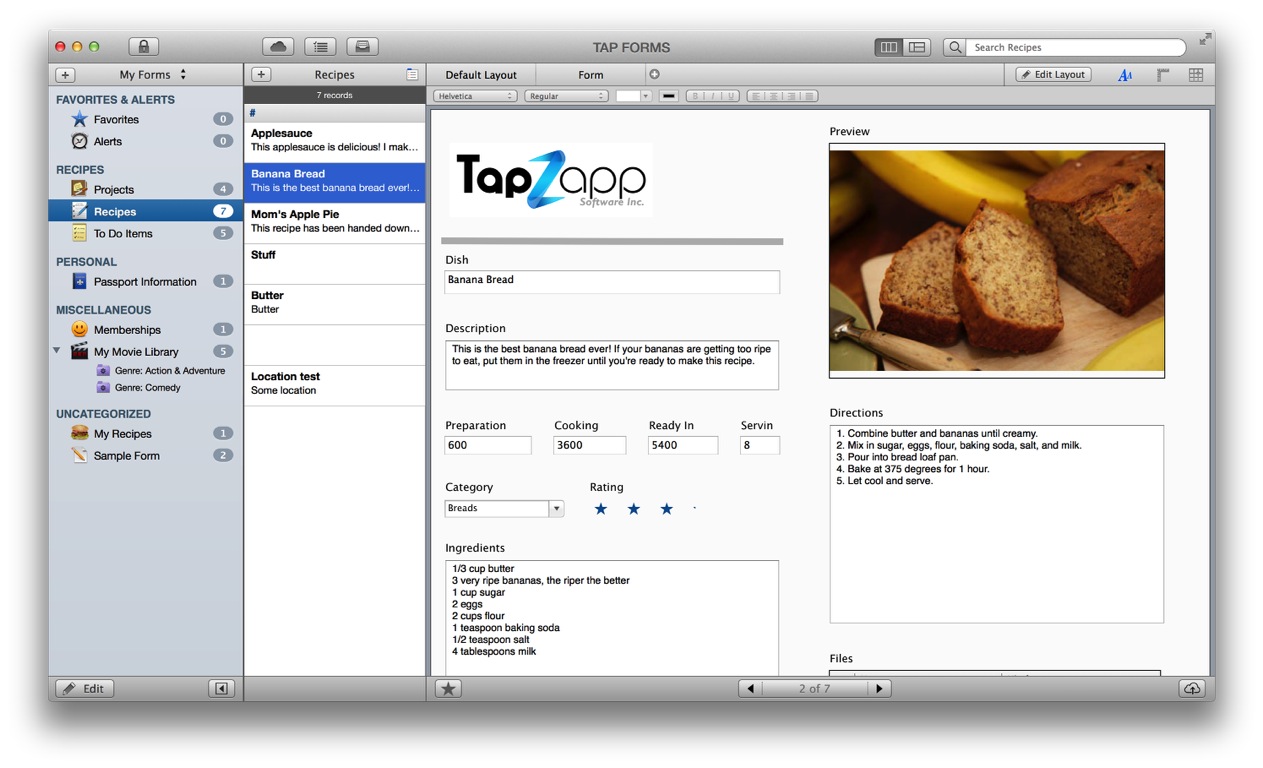

Tap Forms

Using Tap Forms Tap Forms is a fully customizable, easy to use database application. It leverages many of the iPhone’s built in features, and has a similar look and feel as many of the common iPhone apps, such as photos, maps, contacts, browsers, etc. The beauty is that Tap Forms ties them all together using Forms as the main user interface. The Transition Assistance Program (TAP) provides information, resources, and tools to service members and their loved ones to help prepare for the move from military to civilian life. Service members begin TAP one year prior to separation, or two years prior to retiring. For security reasons, TAP and other e-services are not available in most countries outside the United States. Please contact us at 801-297-2200 or taxmaster@utah.gov for more information.

Tap Forms – Organizer Database App for Mac, iPhone, and iPad › Forums › Using Tap Forms. Tunneling software for mac. This forum has 4,716 topics, 17,685 replies, and was last updated 3 hours, 10 minutes ago by Sam Moffatt. Viewing 17 topics - 1 through 15 (of 4,714 total) 1 2 3.

Eligibility

Applicants who qualify for the award under the NYS DREAM Act must meet one of the eligible citizenship/immigration classifications as well as the high school or tuition charge requirements.

To meet NYS residency requirements for student aid, applicant must:

- currently be a resident of NYS, and

- have been a resident of NYS for at least 12 months immediately preceding the first term for which the award is being sought, or

- have been a resident for the last two semesters of high school, or

- have been a resident of NYS at the time of entry into the armed forces, Peace Corps, or AmeriCorps Vista and re-establish NYS residency within six months of release from active duty.

Applying

If you are not eligible to receive federal student aid (also known as Title IV aid), you must simply complete the NYS TAP application under the provisions of the NYS DREAM Act.

Award Amounts

To get an idea of your potential TAP award, use the TAP Award Estimator.

After your TAP application is processed, HESC will notify you by email to log into your HESC account to view the status of your TAP award.

Income

| Student Status Type | NYS Taxable Income Limit |

|---|---|

| Dependent undergraduate students or Independent students who are married and have tax dependents, or Independent students who are unmarried and have tax dependents, or students who qualifed as an orphan, foster child or ward of the court at any time since the age of 13 | $80,000 |

| Independent undergraduate students who are married and have no other tax dependents | $40,000 |

| Single independent undergraduate students with no tax dependents | $10,000 |

Tap Forms Templates

Processing

- Name, address and social security number

- Social security numbers reported for your spouse and your parents, if applicable

- College code

- Only one college code is listed

- Change it if it is not for the college you will attend

- Your marital status, and your parent’s marital status, if applicable

- Income tax filing status for you and your parents, if applicable

- Choices include: will not file, will file NY return, will file federal only

- Other family members attending college

During certain times of the academic year processing times for 'Requests for Information' and 'Change Forms' may vary depending on additional review needed for income verification or residency review. Your award should be considered an estimate until your college has certified your eligibility for TAP.

Student Status

| STUDENT STATUS | REQUIREMENTS FOR INDEPENDENT STATUS |

|---|---|

| Married | The applicant must be married on or before December 31st of the calendar year prior to the beginning of the academic year for which application is made. |

| 35 years of age or older | The applicant has reached the age of 35 on or before June 30th prior to the academic year for which application is made. |

| 22 years of age or older | The applicant is an undergraduate student who has reached the age of 22 on or before June 30th prior to academic year for which application is made AND who meets the basic conditions. |

| Under the age of 22 | The applicant is an undergraduate student who is not 22 years of age on or before July 1st of the academic year for which application is made AND who satisfies both the basic conditions and one of the special conditions. |

| Military Service | The applicant was enlisted in full time active military service, was honorably discharged from such service, and has not and will not be claimed as a dependent by either parent for purposes of either federal or state income tax. Applicant must provide a copy of their DD214 showing an honorable discharge. |

- has not resided and will not reside with parents for more than six weeks; and

- has not and will not receive financial assistance or support valued in excess of $750 from parents; and

- has not and will not be claimed as a dependent by either parent for purposes of either federal or state income tax.

Documentation: Copy of a court order making you a ward of the court or appointing a guardian other than your parents.

Condition: You are receiving public assistance under your own budget and not as a dependent of your parents.

Documentation: Budget statement or other documentation from a social service official showing receipt of public assistance other than food stamps or unemployment insurance. NOTE: Housing Assistance/Budget Letter must be in student’s name.

Condition: There has been an involuntary dissolution of your family resulting in relinquishment of your parents’ responsibility and control.

Documentation: A sworn and signed statement from a person other than yourself or your parents (such as a member of the clergy, a social worker, a legal aid representative, or an official at the facility or institution which has accepted responsibility for your control or care) relating to your family circumstances. The statement must include the specific reasons for relinquishment of parental responsibility and control (such as abandonment by the parents, mental and/or physical abuse by the parents, or parents being neither citizens nor residents of the United States), your relationship to the person making the statement, and how that person has direct knowledge of your family circumstances.

Condition: Both parents are deceased.

Documentation: Copies of death certificates for both parents.

Condition: Both parents have been certified as having a total and permanent disability, or have been declared incompetent by judicial action.

Documentation: Medical certification and court orders. Documentation for both parents is required.

Updating Information

Tap Forms Mac Review

Your VA Transition Assistance Program (TAP)

About 200,000 service members transition to civilian life each year. The Transition Assistance Program (TAP) provides information, resources, and tools to service members and their loved ones to help prepare for the move from military to civilian life. Service members begin TAP one year prior to separation, or two years prior to retiring. Watch the video above to see how VA TAP helps service members transition from military to civilian life.

The VA portion of TAP is a one-day, in-person course called VA Benefits and Services. Led by VA Benefits Advisors, the course helps you understand how to navigate VA and the benefits and services you’ve earned through your military career. The course offers interactive exercises, real examples, and covers topics important to you like family support, disability compensation, education, and health care benefits.

Online Course Instructions

The VA Benefits and Services course is now available online through TAPevents.org to transitioning service members, Veterans, family members, and caregivers. You do not need to be on a CAC-enabled device to access the course.

If you are taking the VA Benefits and Services course as part of a mandatory TAP requirements, you must register for the course using your CAC or by entering your DOD Identification and providing all required information to receive credit. Select “Core Requirements” under TAP Curriculum to find the course.

These former participants in the Transition Assistance Program (TAP) describe their realities of transitioning to civilian life and anecdotal lessons learned to promote the value of the program. TAP helps transitioning service members become more adaptable to civilian life, offers resources for emotional, employment and financial stability and creates a support network that can provide a smooth transition for a Veteran and their family.

VA Benefits and Services Participant Guides

Download the VA Benefits and Services Participant Guide to reference resources, make checklists, and find important contact information.

Guides for the members of the Reserve components

We recognize the unique challenges that members of the reserve components experience in their dual citizen-service member role. The VA Benefits and Services course calls out resources specifically tailored to members of the reserve components. The course also highlights separation documents specific for reserve component-specific eligibility information.

Tap Forms Manual

Download the VA Benefits and Services Participant Guide to reference resources, make checklists, and find important contact information.

Tap Forms Ios

The VA Benefits and Services course has a customer satisfaction rating of 95.7 percent for fiscal year 2019.